what do we pay national insurance for

On any money you earn between 110 and 844 per week - you pay 11 If you earn more than 844 per week theres an extra 1 added on top. The amount you pay depends on your employment status and how much you earn.

|

| How Do I Get A National Insurance Number Everything You Need To Know National Insurance Number National Insurance Insurance |

Both tax and national insurance for the self-employed are paid directly to HMRC.

. Find out more about National Insurance contributions why you pay it and how much you pay. The rate drops to 2 of your earnings over 866 a week. For the 2022-23 tax year between 6 April and 5 July employees must pay National Insurance if they earn more than 9880 in the year. Class 2 is a basic 3 per week if your self-employed profits are below 8632 for the year.

Under the current system people are charged mandatory national insurance if they are over the age of 16 and are. There is no cap. There are 2 higher rates of tax in the UK. Class 1 National Insurance rate.

There are various limits governing what employees pay but the main threshold for employers is 732 a month 169 a week - once your staff earn above that you must start paying employers National Insurance for them. If youre a worker or employee over 16 and earning above 157 per week or are self-employed and generating a taxable profit in excess of 6025 per year you will pay National Insurance. We call this the hidden cost because many employees and budding entrepreneurs do not realise how much National Insurance is paid by employers. Eg if you earn 1000 a week you pay.

For 202122 the weekly rates of Class 1 NIC for employees are as follows. 50270 - 9568 Exempt limit 40702 x 12 488424 NI 12 of your gross earnings. You stop paying Class 4. Your pay is 12 of your earnings above this limit and up to 866 a week for 2017-18.

Do I need to pay National Insurance. This is set to change from 2023 however as the government announced plans to introduce a health and social care levy of 125 percentage points on top of existing National Insurance. NIC earnings thresholds can be calculated weekly or monthly. For anyone earning between 32001 and 150000 they will pay 40 percent and there is a 45 percent tax rate on earning over 150001.

Employers National Insurance thresholds 202021. The actual amount of Class 1 NIC you pay depends on what you earn up to the upper earnings limit which is 967 per week or 4189 per month for 202122. If youre an employee you start paying National Insurance when you earn more than 184 a week 202122. The tax kicks in on earnings in excess of 187 a week at a rate of 12pc and then at 2pc on all other earnings above 976 a week.

National Insurance is paid by employers as well as employees and self-employed workers. National Insurance Calculation Example for the Employed. If you are self-employed. National Insurance contributions count towards the benefits and pensions in the table.

Its a surcharge ie. The bands and personal allowances change annually and it is worth keeping an eye on future changes that are implemented by the government. You do not pay National Insurance after you reach State Pension age - unless youre self-employed and pay Class 4 contributions. You pay mandatory National Insurance if youre 16 or over and are either.

The rates for most people for the 2021 to 2022 tax year are. An additional charge because the applicant will not have paid or not have paid much into the NHS which it has beed decided is unfair to those who have all their lives. The National Insurance rate you pay depends on how much you earn and is made up of. 184 to 967 a week 797 to 4189 a month.

So basically everyone who works in the UK. This is up from the current 2021-22 tax year where National Insurance kicks in on earnings over 9568 in the year. Once you reach state pension age you dont need to pay it at all which effectively reduces your tax bill. 9568 - 50270 - Lets assume your income is 50270 youll be required to pay 488424 towards National Insurance.

But you might have to pay Income Tax on these payments. If youre below State Pension age you must pay National Insurance contributions on your income from employment or self-employment provided that you earn above the minimum amount on. From April these rates. An employee earning above 184 a week.

For 202122 this threshold is 184 a week or 797 a month. Employees pay class one contributions. Self-employed and making a. National Insurance NI is a fundamental component of the welfare state in the United KingdomIt acts as a form of social security since payment of NI contributions establishes entitlement to certain state benefits for workers and their families.

12 of your weekly earnings between 184 and. An employee earning above 184 a week. Employees currently pay National Insurance at the following rates on their earnings. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948 the system has been subjected to.

Who pays National Insurance. From 6 July onwards this threshold will rise to 12570. 9568 or below - NI Exempt 000. Employers pay 138 on every pound the employee earns over 7488.

You pay National Insurance contributions if you earn more than 157 a week. Class 4 is 9 on profits between 8632 and 50000 and 2 for profits above 50000. Look at the cost of private medical insurance that will cover all pre-existing conditions in the UK and you see what a bargain it is and probably volunteer to pay more. National Insurance which is often abbreviated to NI or NIC National Insurance Contribution or NINO National Insurance Number is money that is paid to Her Majestys Revenue and Customs HMRC by employers employees and those who are self-employed.

|

| Understanding The Difference Between P45 P60 Payslips Online Tax Forms National Insurance Number Income Tax |

|

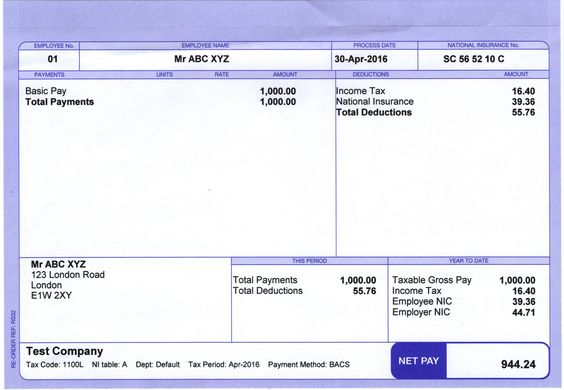

| Get Original Payslips For Your Employ At Each Additional 4 National Insurance Number Company Names Year Of Dates |

|

| Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software |

|

| How To Pay Your Self Assessment Tax Bill With Hmrc Self Assessment Paying Taxes National Insurance |

|

| Pin On Payslips Online Uk |

Posting Komentar untuk "what do we pay national insurance for"